Omar F.

I'm a first time home buyer and Martin Ferreira made it easy for me to understand the process. He always had a quick response time. If and when I purchase another home I will be looking forward to working with Martin again.

5199 Johnson Dr. #110, Pleasanton, CA 94588 | Branch NMLS# 508121

Diversified Mortgage Group delivers the personal service of a local lender, leveraging the resources of a national brand. Currently operating in all 50 states and the District of Columbia, Diversified Mortgage Group branches have earned over 1200 Zillow reviews praising reliable preapprovals, ease of transaction, on-time closings, and transparency and communication throughout the mortgage process.

Throughout the mortgage industry, Diversified Mortgage Group is known for its innovation of product and continued investment in technology. From HomeFundIt, the down payment crowdfunding platform to the All In One Loan, the smarter way to borrow, DIVMG develops mortgage solutions that serve the needs of every borrower.

Diversified Mortgage Group holds federal agency lending approvals with HUD, VA, RHS, GNMA, FNMA and FHLMC. DIVMG loan officers specialize in all new purchase and refinance mortgage needs and act as financial counselors to help borrowers make informed decisions.

Delivering the right loans for the right reasons in a way that exceeds all expectations. That’s our business. Since 1993, CMG Financial, has served home buyers and homeowners nationwide with all of their new purchase and refinance needs. All CMG Loan officers specialize in new purchase and refinance mortgage needs as well as act as a financial counselor to help borrowers make informed decisions.

Our diverse mortgage menu helps us find financing solutions for almost every borrower. We are dedicated to finding more ways to open more doors for home buyers. Find out what “Every Customer, Every Time. No Exceptions, No Excuses.” means to us!

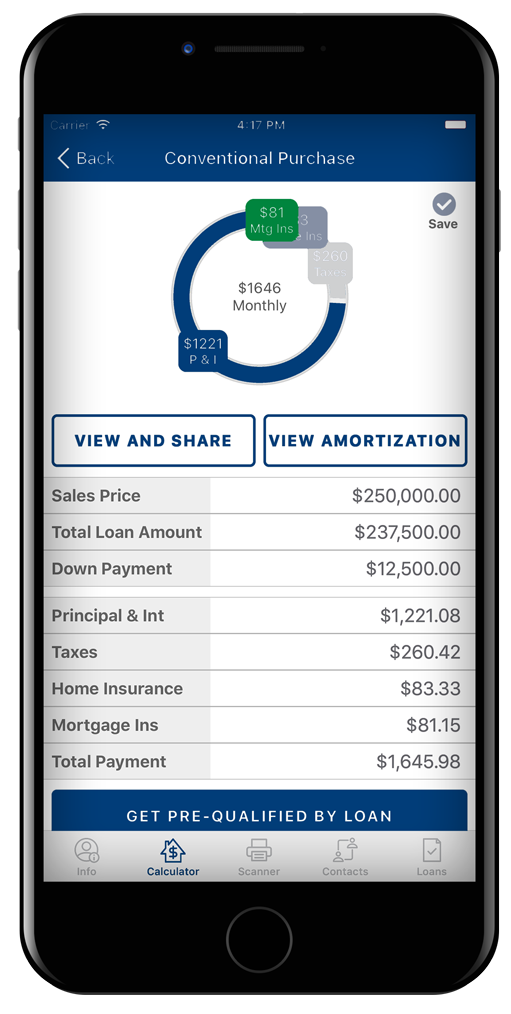

The DIVMG HOME mobile app guides you through your home search and mortgage financing and connects you directly to your loan officer and REALTOR®.